Liberty Mutual Home: Evaluating the Best Personalized Property Insurance Tool offers a fresh perspective on how homeowners can navigate the world of personalized insurance. With an array of features tailored to meet individual needs, Liberty Mutual stands at the forefront of innovation in the home insurance landscape. This comprehensive guide dives deep into the benefits of customization, the tools available for personalization, and what sets Liberty Mutual apart from its competitors.

Understanding the nuances of home insurance can be daunting, but with Liberty Mutual’s personalized offerings, homeowners can find peace of mind knowing their unique coverage needs are met. Armed with customer-centric tools and insights, Liberty Mutual not only prioritizes satisfaction but also aims to empower homeowners in making informed decisions about their property insurance.

Overview of Liberty Mutual Home Insurance: Liberty Mutual Home: Evaluating The Best Personalized Property Insurance Tool

Liberty Mutual offers a comprehensive range of home insurance products designed to protect homeowners from various risks. With customizable coverage options, policyholders can tailor their insurance plan to fit their specific needs, ensuring peace of mind in their home ownership journey. The target audience for these products includes first-time homeowners, families looking for comprehensive coverage, and individuals seeking to protect their investments against potential damages.

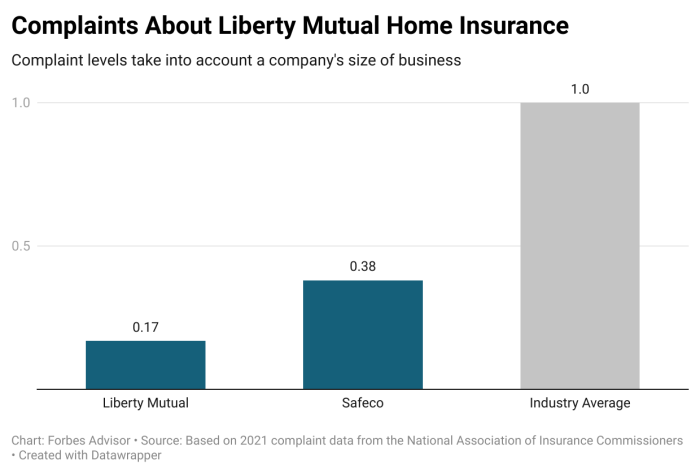

Liberty Mutual has consistently received high rankings in customer satisfaction, boasting a significant market share within the home insurance sector. According to recent industry reports, Liberty Mutual ranks among the top five home insurance providers in the United States, with over 5 million policyholders benefiting from their services.

Benefits of Personalized Property Insurance, Liberty Mutual Home: Evaluating the Best Personalized Property Insurance Tool

Personalized property insurance represents a significant advancement over traditional insurance options. By allowing customization, homeowners can select coverage that aligns with their unique circumstances, ultimately leading to better protection. Customization ensures that homeowners are not paying for unnecessary coverage while simultaneously securing essential protections.

For instance, a homeowner living in a flood-prone area can choose to include additional flood coverage while excluding certain low-risk protections. Key factors that influence the personalization of property insurance policies include the homeowner’s geographical location, the age and condition of the home, and the unique risks associated with personal belongings.

Evaluating the Tools for Personalization

Liberty Mutual provides a suite of tools and resources designed to facilitate policy customization. These include an easy-to-use online personalization tool that allows potential policyholders to tailor coverage options based on their specific needs and preferences.

This user experience is enhanced by interactive features that guide homeowners through the customization process. The step-by-step approach ensures that users are well-informed about their options, making the selection of appropriate coverage both simple and intuitive.

Comparison with Competitors

When comparing Liberty Mutual’s personalized insurance tools with those of other major providers, it becomes evident that they offer unique advantages. While many competitors provide standard coverage packages, Liberty Mutual stands out due to its flexible customization options.

| Feature | Liberty Mutual | Competitor A | Competitor B |

|———————————|—————————–|—————————–|—————————–|

| Customization Options | Extensive | Limited | Moderate |

| User Experience | Highly Intuitive | Standard | Basic |

| Customer Satisfaction Score | 85% | 78% | 80% |

The strengths of Liberty Mutual’s approach lie in its comprehensive customization and strong customer satisfaction ratings, while weaknesses may include higher premiums for certain personalized options.

Customer Experiences and Testimonials

Customers have shared positive experiences with Liberty Mutual’s home insurance, highlighting the benefits of personalized coverage. Many emphasize the ease of customizing their policy to fit their individual needs.

Common themes in customer feedback include appreciation for the flexibility of options and the helpfulness of customer service representatives during the personalization process.

> “I was able to add coverage for my home office without any hassle, which made a huge difference in my peace of mind.” – Sarah, Liberty Mutual Policyholder

Tips for Choosing the Right Coverage

When selecting personalized property insurance, homeowners should consider the following checklist to ensure they make informed decisions:

- Evaluate the specific risks associated with your property.

- Determine the value of your personal belongings.

- Research available customization options and additional coverages.

- Review customer satisfaction ratings and testimonials.

- Consult with an insurance agent to clarify any uncertainties.

Common pitfalls to avoid include underestimating the value of personal property and neglecting to consider potential risks unique to their location. A flowchart can guide individuals through the decision-making process, helping them identify their coverage needs before finalizing their policy choice.

Future Trends in Home Insurance Personalization

The home insurance industry is evolving, with emerging trends focusing on personalization. Technological advancements such as artificial intelligence and big data analytics are paving the way for even more tailored insurance solutions.

As consumer needs continue to evolve, companies like Liberty Mutual are adapting to these changes by enhancing their personalization capabilities. Insights into customer preferences will drive the development of innovative coverage options, ensuring that policies remain relevant and beneficial in an ever-changing risk landscape.