Roofstock Review: Testing the Best Marketplace for Single-Family Rental Investing invites you to explore the unparalleled potential of investing in single-family rental properties. In today’s dynamic market, Roofstock stands out as a premier online platform dedicated to making real estate investment accessible and rewarding. With a user-friendly interface and a wealth of resources, it caters to both seasoned investors and newcomers eager to dive into the world of rental properties.

This review delves into the essential features of Roofstock, showcasing how it transforms the investment landscape. By providing a seamless experience and valuable insights, Roofstock serves as a game-changer for aspiring landlords looking to maximize their returns.

Overview of Roofstock: Roofstock Review: Testing The Best Marketplace For Single-Family Rental Investing

Roofstock is an innovative online marketplace designed specifically for single-family rental investing. It connects real estate investors with a wide array of properties available for purchase and rental. With its user-friendly platform, Roofstock simplifies the investment process, allowing investors to purchase properties remotely and manage them effectively. The significance of Roofstock in the single-family rental market lies in its ability to democratize real estate investment, enabling both seasoned and new investors to access lucrative opportunities without geographical limitations. This platform primarily targets individual investors looking for passive income through rental properties, as well as those seeking to diversify their investment portfolios.

Features of Roofstock

Roofstock offers a range of features that make it appealing to investors. Among its key offerings are:

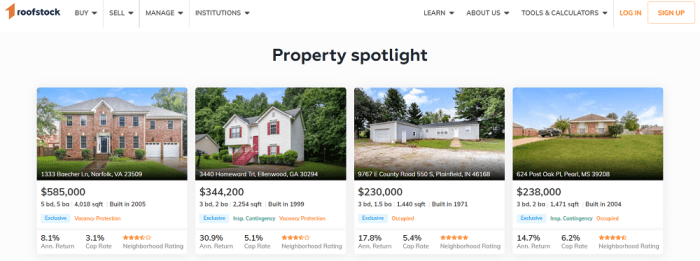

- Property Listings: A diverse array of verified single-family rental properties across various markets.

- Cash Flow Analysis: Comprehensive estimates of potential rental income and expenses for each property.

- Tenant-Occupied Properties: Many properties come with tenants already in place, ensuring immediate cash flow.

- Roofstock Certification: Properties are evaluated and certified by Roofstock, providing buyers with peace of mind.

- Market Data: Access to valuable market insights and analytics to inform investment decisions.

Compared to other platforms in the rental marketplace, Roofstock stands out with its focus on single-family homes and its emphasis on providing a seamless online experience for investors. Below is a comparison table highlighting the features and benefits of using Roofstock:

| Feature | Roofstock | Competitor A | Competitor B |

|---|---|---|---|

| Property Certification | Yes | No | No |

| Tenant Occupancy | Yes | No | Limited |

| Market Analysis Tools | Comprehensive | Basic | Basic |

| Support Resources | Extensive | Moderate | Limited |

User Experience

Roofstock’s user interface is designed with simplicity and ease of use in mind. The platform allows users to navigate through property listings effortlessly, with filters to refine searches based on price, location, and property type. New users will find the layout intuitive, with clear calls to action and helpful tooltips guiding them through the investment process.

To navigate the Roofstock platform effectively, users can follow these steps:

- Sign up for a free account to access property listings.

- Utilize the search filters to find properties that meet specific investment criteria.

- Review property details, including cash flow projections and tenant information.

- Engage with the various analytical tools to evaluate potential investments.

- Contact Roofstock’s support team if assistance is needed.

Despite its user-friendly nature, some users may encounter challenges such as understanding the market data or financing options. To overcome these challenges, users can take advantage of Roofstock’s educational resources, including webinars and guides specifically designed to enhance investor knowledge.

Investment Opportunities, Roofstock Review: Testing the Best Marketplace for Single-Family Rental Investing

Roofstock offers a vast selection of investment properties, including single-family homes in various locations across the United States. Investors can choose from portfolios that include properties in growing markets, urban areas, and suburban neighborhoods, with a focus on high-demand rental regions.

The geographical areas with the most investment opportunities on Roofstock include:

- Atlanta, Georgia

- Dallas, Texas

- Indianapolis, Indiana

- Jacksonville, Florida

- Phoenix, Arizona

Investors can realize significant potential returns through Roofstock, with many properties offering cash flow returns that exceed traditional rental methods. This approach not only diversifies investment portfolios but also enhances financial stability over time.

Fees and Costs

Understanding the fee structure associated with using Roofstock is essential for investors. Roofstock charges a flat listing fee for sellers and a transaction fee for buyers, which is a percentage of the purchase price. This setup is transparent and straightforward, allowing investors to budget effectively.

A breakdown of initial versus long-term costs involved in property investment through Roofstock includes:

- Initial Costs: Purchase price, due diligence costs, and closing fees.

- Long-Term Costs: Property management fees, maintenance costs, and taxes.

A comparison of fees with other rental investing platforms is provided below:

| Platform | Listing Fee | Transaction Fee |

|---|---|---|

| Roofstock | Flat fee | 1% of purchase price |

| Competitor A | Variable | 2% of purchase price |

| Competitor B | No fee | 3% of purchase price |

Customer Support and Resources

Roofstock provides robust customer support options for users, ensuring that investors have the assistance needed throughout their investment journey. Support includes:

- Email support with rapid response times.

- Phone support for immediate assistance.

- Dedicated account managers for premium users.

Additionally, Roofstock offers various resources to assist investors, including guides on financing, property management, and investment strategies. This wealth of information empowers users to make informed decisions.

Common concerns addressed by Roofstock’s support include:

- Understanding the buying process.

- Evaluating investment properties.

- Accessing financing options.

Success Stories

Investors using Roofstock have shared numerous success stories highlighting their positive experiences. Testimonials from successful investors demonstrate the platform’s effectiveness in generating substantial returns on investment.

For instance, one investor reported a 20% return on investment after purchasing a property in Atlanta, citing Roofstock’s resources and support as critical to their success.

Visual illustrations of success metrics achieved by Roofstock users can include graphs depicting portfolio growth over time or charts showcasing average rental yields, emphasizing the tangible benefits of the platform.

Risks and Considerations

Investing in properties through Roofstock carries certain risks that investors should be aware of. Potential risks include market fluctuations, tenant vacancies, and maintenance costs.

Important considerations before using the platform include:

- Conducting thorough due diligence on properties.

- Understanding local market trends.

- Evaluating the financial viability of the investment.

To mitigate risks when investing in rental properties through Roofstock, consider the following tips:

- Diversify your portfolio across different markets.

- Utilize Roofstock’s market analysis tools effectively.

- Establish a contingency fund for unexpected expenses.